Mercedes-Benz Mobility AG

Siemensstr. 7

70469 Stuttgart

Deutschland

Tel.: +49 711 17 0

E-Mail: mobility@mercedes-benz.com

Please send queries about content on this website to any contact. You can address your concerns to us in English and your respective national language.

Represented by the Board of Management: Franz Reiner (Chairman), Jörg Lamparter, Susann Mayhead, Christina Schenck, Peter Zieringer

Chairman of the Supervisory Board: Harald Wilhelm

Commercial Register Stuttgart, No. HRB 737788

VAT registration number: DE 81 11 20 930

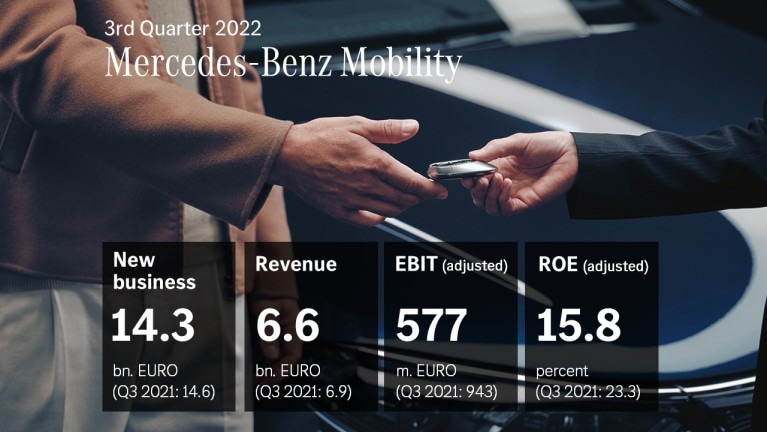

Here you can find the interim reports of Mercedes-Benz Mobility (Daimler Mobility until 2021).

![[q1_2024:MEDIASTORE_LEAF]@2d0a42af](/images/mbm-relaunch/who-we-are/key-figures/q1-2024_ratio_16x9_s.jpg)

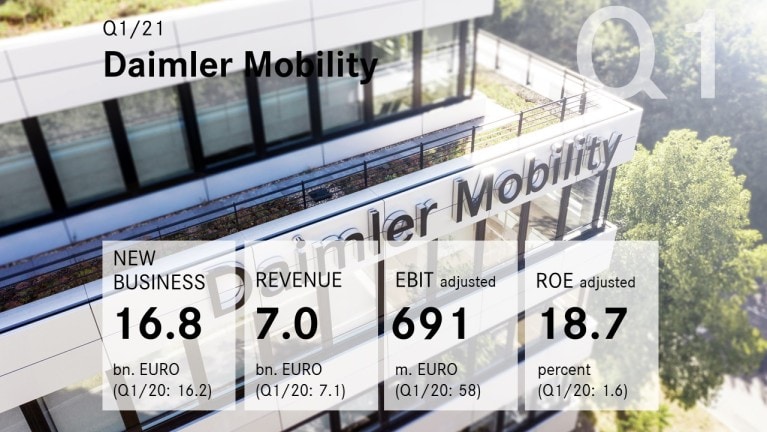

Compared to the first quarter of the previous year, Mercedes-Benz Mobility almost doubled its new business volume for BEVs to €2.0 billion (Q1 2023: €1.2 billion).

![[q3_2023:MEDIASTORE_LEAF]@15f91ac5](/images/mbm-relaunch/who-we-are/key-figures/q3-2023_ratio_16x9_s.jpg)

In the third quarter of 2023 Mercedes-Benz Mobility’s new business increased to €15.2 billion and is above the level of the prior-year period (Q3 2022: €14.3 billion).

![[q1_1:MEDIASTORE_LEAF]@7dfbc798](/images/mbm-relaunch/who-we-are/key-figures/q2-2023_ratio_16x9_s.jpg)

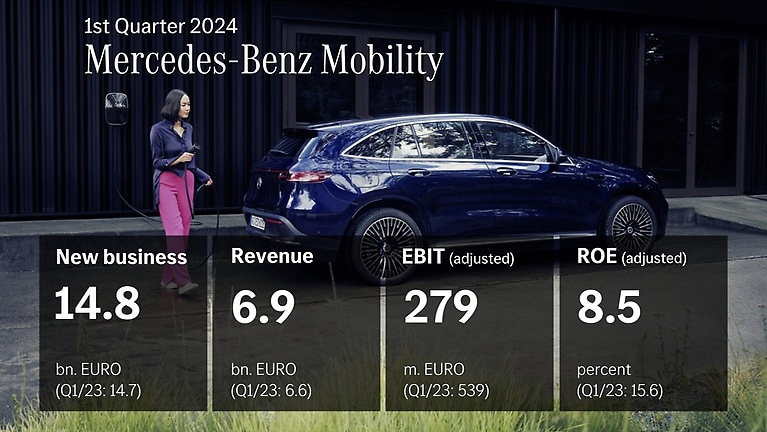

Mercedes-Benz Mobility tripled new business volume for BEVs (battery electric vehicles) to €1.8 billion (Q2 2022: €0.6 billion).

![[q1_2023:MEDIASTORE_LEAF]@5b8e36e7](/images/mbm-relaunch/who-we-are/key-figures/q1-2023_ratio_16x9_s.jpg)

Compared to the first quarter of the previous year, Mercedes-Benz Mobility was able to more than double the new business volume for BEVs (battery electric vehicles) to €1.2 billion (Q1 2022: €0.5 billion).

![[q3_2022:MEDIASTORE_LEAF]@6a29a147](/images/mbm-relaunch/who-we-are/key-figures/q3-2022_ratio_16x9_s.jpg)

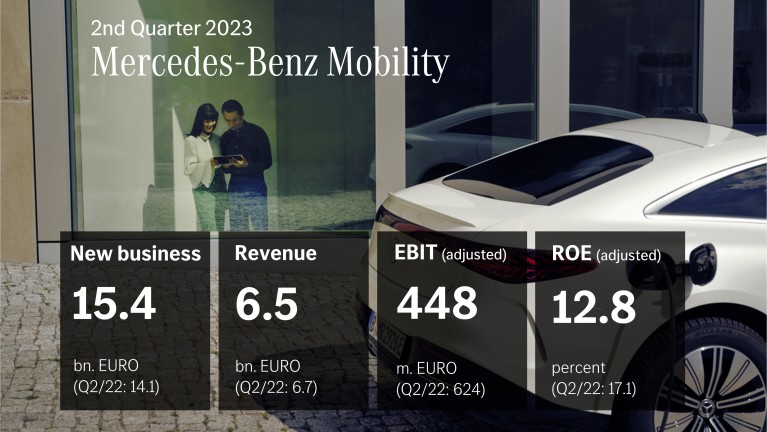

In the third quarter of 2022, Mercedes-Benz Mobility reached an adjusted Return on Equity (RoE) of 15.8%. The new business of Mercedes-Benz Mobility declined slightly by 3% to €14.3 billion compared to the prior-year’s quarter.

![[q2_2022:MEDIASTORE_LEAF]@c2d02bc](/images/mbm-relaunch/who-we-are/key-figures/q2-2022/q2-2022_ratio_16x9_s.jpg)

The secondquarter of 2022 shows us that we can perform well even in a dynamic and challenging environment if we work attentively, work as a team and pull in the same direction.

![[mobility_q1_2022_teaser_v2_de:MEDIASTORE_LEAF]@63055961](/bilder/mbm-relaunch/kennzahlen/q1-2022/mobility_q1-2022_teaser-v2_de_ratio_16x9_s.jpg)

The first quarter of 2022 shows us that we can perform well even in a dynamic and challenging environment if we work attentively, work as a team and pull in the same direction.

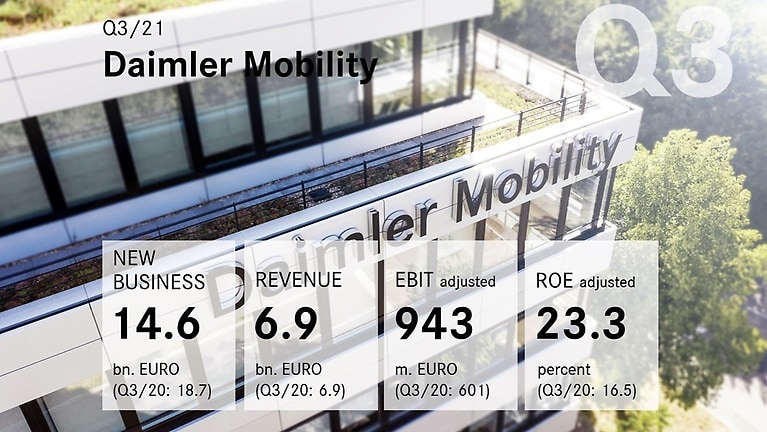

![[zwischenbericht_q3_1:MEDIASTORE_LEAF]@63146aa7](/images/mbm-relaunch/who-we-are/key-figures/interim-report-q3-2021_ratio_16x9_s.jpg)

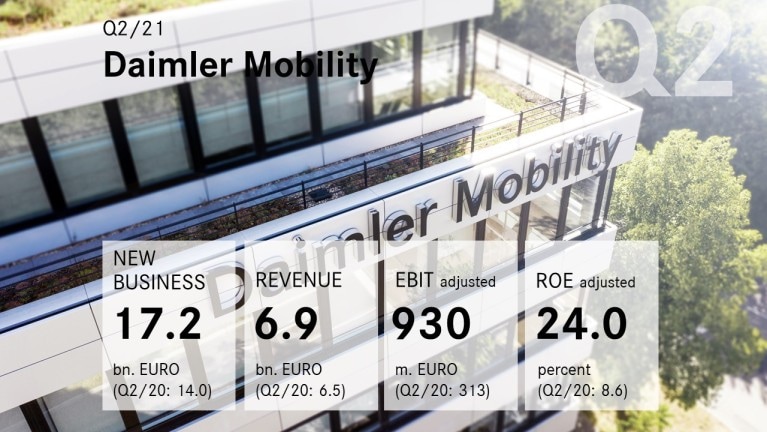

![[zwischenbericht_q2_2021:MEDIASTORE_LEAF]@3dfdd668](/company/key-figures/interim-reports/q2-2021/interim-report-q2-2021_ratio_16x9_s.jpg)

![[zwischenbericht_q1_2021:MEDIASTORE_LEAF]@2a25a93c](/company/key-figures/interim-reports/q1-2021/interim-report-q1-2021_ratio_16x9_s.jpg)